Originally posted February, 2009

As I have said before, so much of what I can now "teach" was learned the hard way. Here are some lessons learned...

What is my actual income?

Let's say you make $40,000 a year. If someone were to ask you your income, you would probably say $40,000. That's where some of us get into trouble. When we spend money, we are thinking $40,000. Wrong... your actual income is not your gross but your net income after taxes, Social Security, insurance, etc. is taken out.

Do the math, figure out what your net income is, and keep that amount in your mind when you are making your budget or spending money. You'll be surprised at how it changes your outlook.

How much does this cost me a year?

This is a question I ask Christopher once in awhile. Spending $1.00 a day on bottled water may not seem like a lot (unless you are over 50 and paying for water is still weird). However, multiply that by five to seven days times fifty-two weeks... are you sure you are that thirsty? It is far better to purchase water by the case and take it from home. Better yet is to make a one time purchase of a thermos or other container and fill it up with water from home.

I think that is why Starbucks is in trouble, people who used to purchase their coffee on the way to work each morning are no longer able to spend that kind of money on a daily basis.

I do the same math when thrift shopping. If an object is something I don't really need and I have to think about where to put it... I don't make the purchase no matter how cheap it is. I've started doing the math... $3.00 for a thrift store purchase multiplied by fifty-two weeks in a year? It's amazing how losing one-third of your income makes you rethink Goodwill and garage sales. :)

My Money or My Life

Remember the famous book where the authors have you "do the math", figuring out how many hours it will take you to pay for a purchase with your net income. It woke a lot of people up, not only to be more careful with purchases but to the fact they can live a much better lifestyle as a result of spending less.

Is the joy of driving a $50,000 car around town worth how much extra you have to work to pay for it as opposed to... say... paying $12,000 for a really good used car? Is eating out three or four times a week, going to the mall a few times a month, season tickets to the Bears games, etc. worth having the wife work outside the home if she would rather be home with the kids?

Well, as far as the Bears tickets go... don't ask my husband.

Can I Find a Cheaper Way to Get the Same Result?

This is where the rubber meets the road in decorating our homes, cooking meals, making celebrations for friends and family, etc. It is also where some of my blog friends (like Manuela) have genius ideas that I steal... I mean copy.

Here's an example, I was browsing the gift shop at the hospital yesterday (where we are trying to get help so Christopher can have his surgery) and saw the cutest "sign" which spelled out FAMILY. It was made of individual letters that were hinged together. It was also quite expensive. Next to it was a far cheaper metal sign that also spelled out FAMILY. Just as cute for far less money but still more than I can afford.

If I decide I really want something like this in my home, I'll make a trip to Michael's or Hobby Lobby for ideas. It will also go on my thrift store and garage sale radar. I have learned to ask myself this question many times over the years... what is it I like about an object, can I make the same thing at home, would something similar give me the same "feeling" or "look", etc.

I do this same thing when looking at a picture of a lovely home, an amazing garden, a beautifully set table, etc. What is it about this scene that causes me to love it and how can I recreate this at home without spending money (or at a small cost)?

It's the same with eating out... I LOVE to eat out. But do I need to eat an entire meal? Can I get the same experience by just going out for dessert and coffee? There are times when, of course, we need an entire meal but if it is experience we are after... coffee and pie may be all we need.

At the End of My Life, What Do I Want My Checkbook to Show?

I have friends whose house is... not beautiful. That's all I'll say. Even though they make very, very good money. Unlike me, having a warm and cozy and lovely dwelling place is not a priority.

However, their family has taken exotic and amazing vacations all over the world. I don't know of any other family (among my friends) that has had the travel experiences they have had. Except for their children's education, most of their "extra" income went to these vacations.

Their kids are now out of the home and they have wonderful memories. It's not the way I would have spent my money (I'm a terrible traveler, I get sick on cars and planes and trains and whatever else moves.) But it worked for them.

Frugal Luxuries

Somewhat along those lines of thinking... one has to have a few luxuries here and there. The expense of those luxuries will be different based upon your income, if you are saving for a special purchase, etc... but even if you are on a limited income like us, you must have a luxury here and there are bitterness will be your companion.

An example... $4.00 a day for my morning cup of coffee is far more than I would pay (even if we were not on Disability). However, $4.00 for a Starbucks once a month is possible. A Pumpkin Spice Latte is an experience when it is slowly slipped, with eyes closed, breathing in the aroma. It is a cheap vacation. Spending $5.00 each day at Panera is far beyond my ability right now but investing $5.00 once or twice a month to "get away from it all" with a book, a notebook, and a pen is priceless.

I pay just a little more for my Seventh Generation dish soap (I can no longer afford Mrs. Meyers but I can still purchase Seventh Generation at Target!) and purchasing a very good quality liquid hand soap for my kitchen sink is a frugal luxury, since I spend so much time doing dishes and washing my hands while cooking.

The concept of frugal luxuries could (and has) filled an entire post before...

So, there you have it, lessons learned... many times the hard way. I hope they give you something to ponder today.

Note: The term Frugal Luxuries

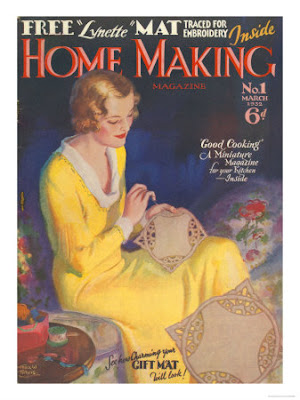

Picture: Homemaking Magazine: allposters.com